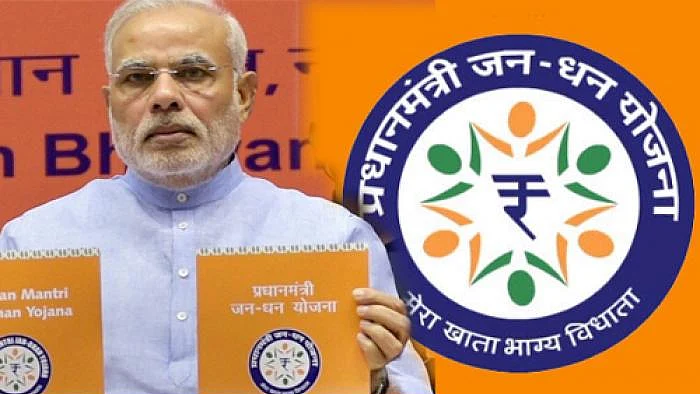

The Narendra Modi-led government has long touted the Pradhan Mantri Jan Dhan Yojana (PMJDY) as a resounding success, citing it as evidence of India’s progress in financial inclusion and poverty reduction. However, recent analyses and investigative reports reveal glaring contradictions in these claims, raising critical questions about the effectiveness of these initiatives and exposing the BJP government’s tendency to prioritize optics over genuine economic progress.

A Grand Illusion of Financial Inclusion

In August 2024, the Indian government marked a decade of PMJDY, celebrating its achievements in bringing financial services to the masses. Union Finance Minister Nirmala Sitharaman claimed that 53 crore people had been integrated into the formal banking system, an unprecedented feat. The government further cited this achievement as a key factor in lifting 25 crore Indians out of poverty. The National Institution for Transforming India (NITI Aayog) also credited the program for India’s improved performance on the Multidimensional Poverty Index (MPI).

On the surface, these statistics suggest a significant reduction in poverty and a leap in financial inclusion. However, a deeper examination exposes a different reality: the mere opening of bank accounts does not equate to meaningful economic participation or financial security. The Modi government, in its characteristic style, has once again used manipulated data to paint a misleading picture of progress.

Boastful Claims vs. Harsh Realities

A research paper by economist Suyash Rai, published in December 2024, critically assesses the Modi government’s financial inclusion narrative. His findings reveal that while millions of bank accounts have been opened under PMJDY, a substantial portion remains inactive. The World Bank’s 2021 Global Findex Database supports this claim, showing that 35% of Indian bank accounts were inactive, the highest among middle-income countries where the median inactivity rate was just 7%.

Inactive accounts indicate that individuals are not utilizing banking services for savings, credit, or transactions, undermining the claim that financial inclusion has significantly improved livelihoods. Instead, many of these accounts were opened due to government mandates and bank directives rather than genuine economic participation by account holders. This exposes the Modi government’s hollow claims, proving that their financial inclusion drive is more about scoring political points than delivering real economic benefits.

The Truth Behind the Numbers

The primary issue with the Jan Dhan Yojana lies in its top-down approach. Instead of fostering organic financial participation, the government emphasized rapid account openings to meet statistical goals. This approach mirrors past pilot studies, such as the Gulbarga and Cuddalore experiments conducted in the mid-2000s, which revealed similar patterns of low account utilization. These studies found that over half of newly opened accounts remained dormant, with only a small fraction being used regularly for deposits or transactions.

Despite these early warnings, the Modi government proceeded with an aggressive financial inclusion strategy, prioritizing numbers over meaningful engagement. Banks, under pressure from regulatory bodies, focused on meeting account-opening targets rather than educating or empowering customers to use their accounts effectively. This reckless pursuit of optics has not only led to wasted resources but also demonstrated the BJP’s inability to design policies that address the real economic needs of the poor.

Jan Dhan Yojana’s Structural Failures

Beyond the inefficacy of PMJDY in driving real financial inclusion, the Modi government leveraged these numbers to manipulate poverty statistics. The NITI Aayog modified the methodology of the national MPI by adding a new parameter: if a household had even one active bank or post office account, it was no longer considered deprived. This meant that regardless of whether individuals actively used their accounts or benefited from financial services, they were counted as having escaped poverty.

This methodological tweak significantly altered India’s poverty figures, allowing the government to claim that nearly 25 crore people had been lifted out of poverty between 2013-14 and 2022-23. However, independent analyses estimate that this approach led to an underestimation of India’s poor by at least 3.7 crore people compared to global MPI calculations.

The Modi government has thus used a rigged methodology to fabricate its success story, misleading the public and the global community. This deliberate data manipulation is not just unethical but also demonstrates a blatant disregard for the struggles of millions who continue to live in deprivation.

Data Manipulation: The BJP’s Favorite Trick

The financial inclusion debacle is not an isolated case but rather part of a broader pattern of policy decisions that prioritize political narratives over genuine impact. India’s 2016 demonetization move, intended to curb corruption, led to widespread economic distress. Similarly, the 2020 COVID-19 lockdown, one of the most stringent globally, disproportionately affected the poor and informal workers. The PMJDY scheme follows the same trajectory: a grand policy announcement with little regard for its real-world consequences.

The BJP government has consistently shown a dangerous willingness to experiment with the economy without fully understanding the repercussions. By prioritizing flashy announcements over well-planned, sustainable reforms, it continues to gamble with the lives of ordinary citizens.

Repeating Economic Disasters: A Pattern of Failure

To put India’s financial inclusion efforts in perspective, consider Brazil’s Bolsa Familia program and Indonesia’s financial inclusion model. These programs succeeded because they combined financial literacy initiatives, targeted subsidies, and digital transaction incentives to ensure active participation rather than just account openings. Unlike PMJDY, which is largely a symbolic initiative, these countries have demonstrated that financial inclusion must be coupled with systemic economic support to be effective.

The Cost of Deception

The Modi government’s obsession with grand narratives and manipulated statistics comes at a steep cost. By prioritizing political propaganda over genuine financial inclusion, it continues to betray the very citizens it claims to uplift. The illusion of economic progress may serve the BJP’s electoral ambitions, but it does little to address the harsh realities of unemployment, economic disparity, and financial distress that millions of Indians still face. Until the government shifts its focus from misleading optics to tangible economic empowerment, the so-called success of PMJDY and similar initiatives will remain nothing more than a political mirage.

The author Ramsha Waheed holds a Master’s degree in English Literature with expertise in research and content writing.

You can reach her at ramshawaheed01@gmail.com.