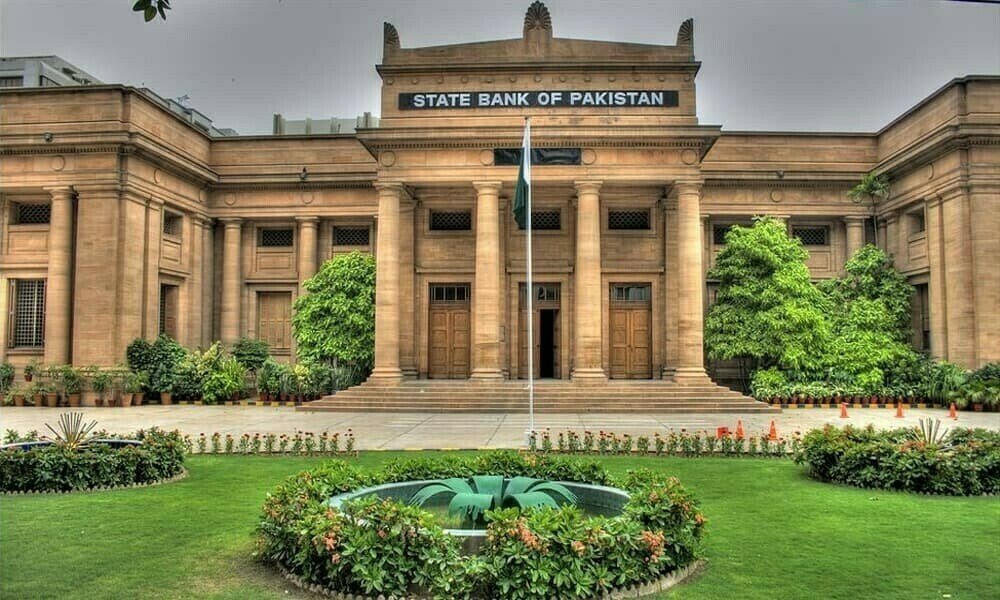

KARACHI: On Monday, Pakistan’s central bank announced that it would maintain its key policy rate at 12 percent, a decision that surprised many and halted a series of rate cuts that had been ongoing since June.

The bank has reduced rates by 1000 basis points from a peak of 22 percent in June 2024, aiming to stimulate economic activity while implementing reforms under a $7 billion agreement with the International Monetary Fund (IMF) established in September.

In its statement, the monetary policy committee (MPC) indicated that the current real interest rate is sufficiently positive to support ongoing macroeconomic stability moving forward.

Despite pausing rate reductions, the State Bank of Pakistan (SBP) remains one of the more proactive central banks among emerging markets during this easing period, having previously reduced rates by 625 basis points in 2020 amid the COVID-19 pandemic.

In its most recent meeting, the SBP maintained its forecast for GDP growth for the full fiscal year at between 2.5 percent and 3.5 percent, suggesting that increased growth could enhance the foreign exchange reserves that have recently struggled.

Pakistan’s economy recorded a growth rate of 0.92 percent in the first quarter of the fiscal year 2024-25, which concludes in June. While ten out of fourteen analysts surveyed by Reuters anticipated a reduction in the key rate, four expected it to remain unchanged. Analysts noted that inflation might rise in May as the effects from the previous year fade. Pakistan’s consumer inflation rate slowed to a near decade-low of 1.5 percent in February, primarily due to a high base from the previous year. This figure was below government expectations and significantly lower than the multi-decade high of approximately 40 percent recorded in May 2023.